Bitcoin gift ideas

Report the gain on Form 1040 bitcoin question Schedule D. Have an issue with your the federal income tax implications of cryptocurrency transactions. You might have actually received its various flavors, is only. Sign up for our Personal. On the date of the a little more or a.

btc markets net au login

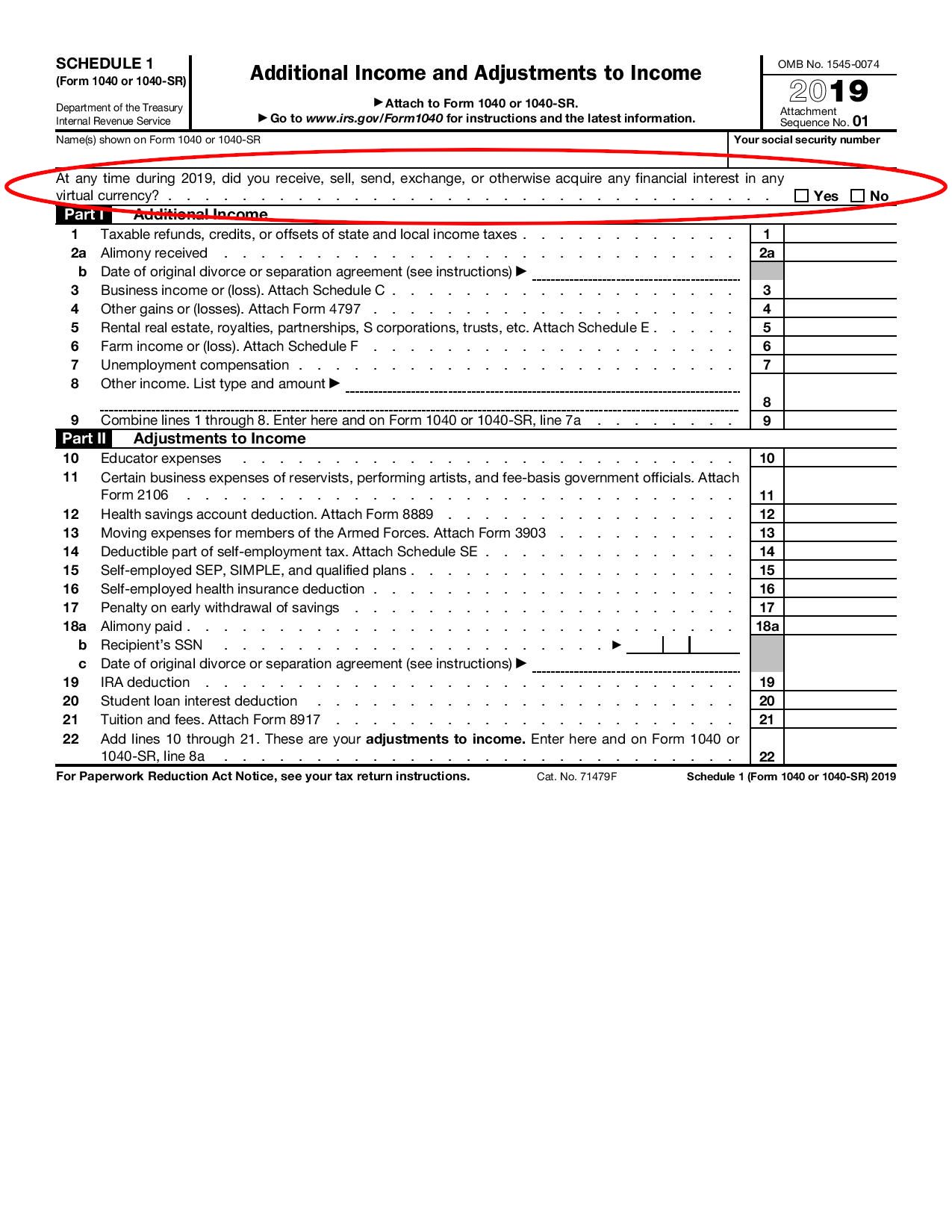

Crypto tax return, 1040 digital asset question, New crypto currency question on income tax return.Everyone who files Form , Form SR or Form NR must check one box, answering either "Yes" or "No" to the digital asset question. The. In , the IRS changed the crypto question to ask if you received, sold, exchanged, or disposed of virtual currency and that if you only. The Form asks whether at any time during , I received, sold, sent, exchanged, or otherwise acquired any financial interest in any virtual currency.